How To Calculate Pre Money And Post Money Valuation

What is Post Money Valuation?

Post money valuation is the equity value of a company after it receives the cash from a round of financing information technology is undertaking. Since adding cash to a company's residual sheet increases its equity value, the post money valuation will exist higher than the pre money valuation because it has received additional greenbacks.

Share Price vs. Equity Value

The post money value of a visitor refers to the total value of its equity, and not the private share price. Although the equity value volition be impacted past putting additional greenbacks on the residue canvass , the individual share cost will be unaffected. The example below shows how that'south the case.

Post Money Valuation Case

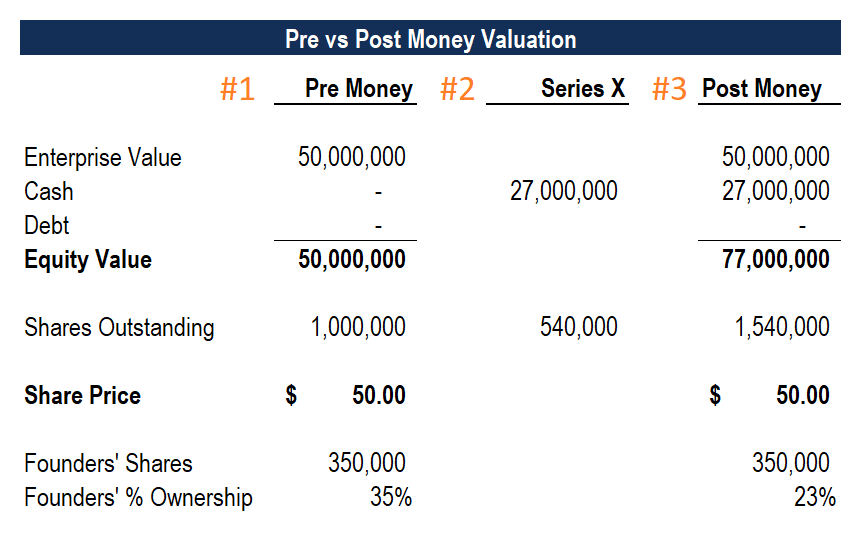

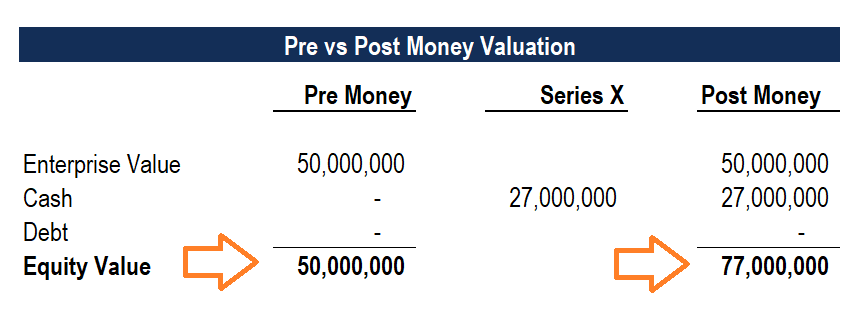

Beneath is a three-part example of how to calculate the postal service money valuation of a company undergoing a Series 10 funding round.

Part 1

The visitor below has a pre money disinterestedness valuation of $50 one thousand thousand. Earlier the round of financing, the company has one million shares outstanding, and thus a share price of $fifty.00.

Function 2

The visitor will raise $27 1000000 of new equity at the pre money valuation of $50 million, which results in it issuing 540,000 new shares.

Part three

The visitor will add the $27 one thousand thousand of cash (assuming no transaction costs) to its pre coin value of $50 million to get in at a mail service money valuation of $77 million. Postal service-transaction, the company will have i.54 1000000 shares outstanding, and therefore, its share toll remains $l.00.

Enterprise Value vs. Equity Value

The enterprise value of a business is the value of the entire company without because its capital structure . A company's enterprise value is non affected by a round of financing. While the company's mail service coin equity value increases by the value of greenbacks received, the enterprise value remains constant.

Anti-dilution

When undergoing a round of financing, the original shareholders (pre-transaction) will take their proportional buying diluted as a outcome of issuing new shares. Per the example above, the founders had 350,000 shares before the Serial X financing, which represented 35% of the total shareholding. Mail-transaction, they will nevertheless take 350,000 shares, but it will only represent 23% of the total. The value of their stake remains the aforementioned (350,000 ten $fifty = $17.5 million).

Download Gratuitous Excel Template

Enter your proper name and email in the form below and download the free template now!

Pre Money Mail Money Valuation Assay Template

Download the free Excel template at present to advance your finance noesis!

Valuation Techniques

Companies that are undergoing a financing round (i.due east., Series 10) will need to negotiate with potential investors about what the visitor is worth.

The about common valuation methods are:

- Discounted Cash Flow (DCF)

- Comparable Companies (aka Trading Multiples, or Public Comps)

- Precedent Transactions

To acquire more about each of the above techniques, run across CFI'due south guide to valuation methods .

Post Money Valuation Formula

To calculate the post coin valuation, use the post-obit formula:

Post Money Value = Pre Money Value + Value of Cash Raised

or,

Post Money Value = Pre Money Share Price 10 (Original Shares Outstanding + New Shares Issued)

Valuation Expectations

Since the value of a visitor can be very subjective, and because founders often have optimistic forecasts for the company, Venture Uppercase (VC) firms almost always invest via preferred shares to "span the valuation gap."

By investing via a preferred share (equally opposed to common shares), the VC firm obtains certain advantages:

- Liquidation preference (they are paid their capital dorsum start if the visitor liquidated or sold)

- Preferred dividend (they are paid a preferred return on the investment)

- Upside participation (they may get asymmetric exposure to the upside)

- Anti-dilution provisions (protection from boosted dilution in future funding rounds)

Considering at that place is incremental value in the share features above, the VC firms' preferred shares are more valuable than common shares. In essence, the VC firm gets to buy preferred shares at a common share toll, improving its investment return profile.

Additional Resources

Cheers for reading CFI's guide to Mail service Money Valuation. To proceed advancing your career, the additional resources beneath will exist useful:

- DCF Modeling Guide

- Private Equity vs Venture Majuscule, Angel/Seed Investors

- Seed Financing

- Venture Capital Investing

Source: https://corporatefinanceinstitute.com/resources/knowledge/valuation/post-money-valuation/

Posted by: mashburnbremand.blogspot.com

0 Response to "How To Calculate Pre Money And Post Money Valuation"

Post a Comment